By clicking "Book An Appointment Here" button, you acknowledge that you have read and agree to the Privacy Policy. Submission of your information constitutes permission for a licensed agent to contact you with additional information about the cost and coverage details of health plans. You also agree to receive text messages from

Anthony Gable with USA Benefits Group USA Benefits Group/The Gable Agency. Message and data rates may apply. Message frequency varies.

Anthony Gable is a Benefits Expert

I have been licensed since 1991 and my goal is to help my clients protect their families and business from the impact of the high cost of medical care.

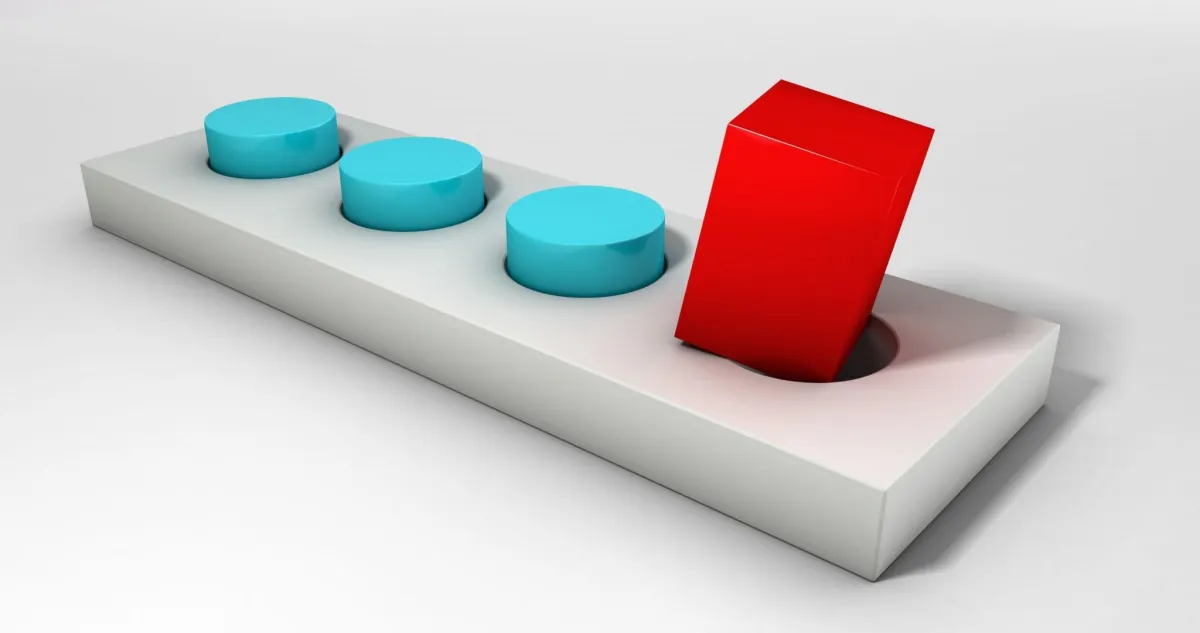

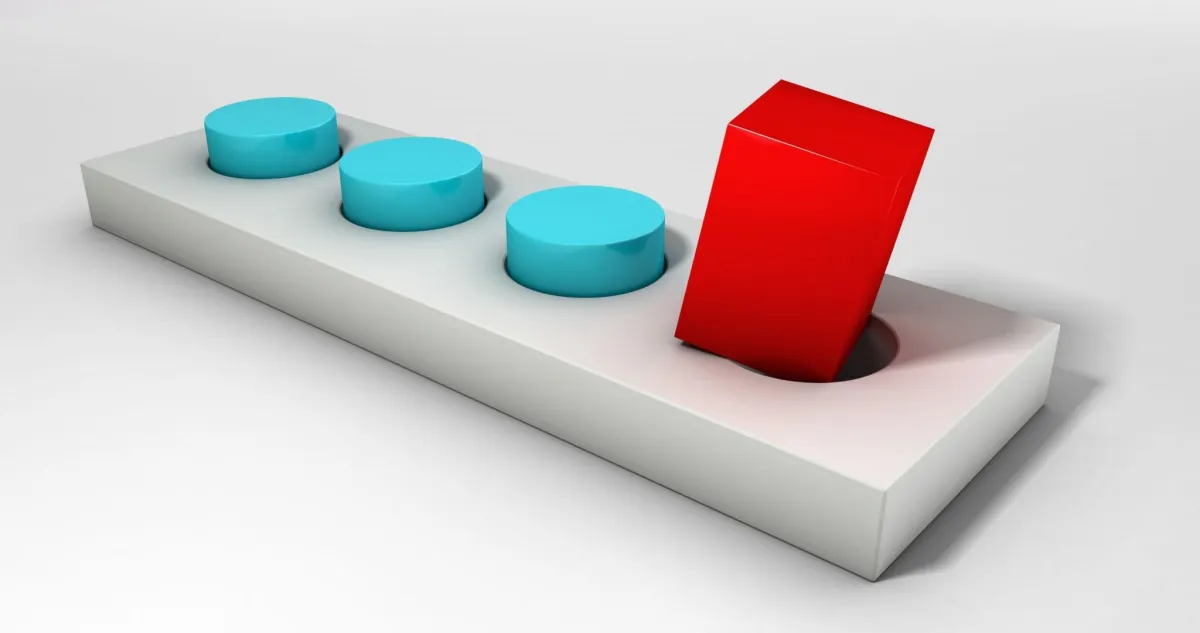

Why it is important to use an independent agent and avoid captive agents

Independent agents work for you

There are many captive agents in the market today, they only sell one company. They are fantastic sales people, and can creatively describe how all the different pegs fit into their round hole, regardless of their shape. Independent agents do not need to do this, they work with all the companies, so they make sure the round pegs get round holes.. and the square pegs get square holes. Let Anthony find the right shape for you.

USA BENEFITS GROUP

USA Benefits Group is a nationwide network of independent health and life insurance professionals that have been serving individuals, small-business owners and the self-employed since 1988. We offer Health Insurance, Critical Illness, Accident Plans, GAP Plans, Dental Plans, Rx Drug Plans, Life Insurance, Medicare Supplements, Annuities and many other insurance products. USA Benefits Group provides a comprehensive and ongoing training program to it's agents so they are better prepared to serve their clients. Our agents represent you, the client, and they are committed to meeting your needs and matching you up with the most appropriate and affordable insurance solutions.

"We are a full service agency, we can help every customer regardless of their financial situation, or their medical history. We are better positioned than any other agency in the market to help agents be successful, with our tools, training, lead programs, support, and the best carriers in the business, we will all win together"

Rick Banville - USABG CEO

Alternative plans

These plans are available for people who can qualify! There are many alternatives, including Short term medical plans - that work like the plans did before Obamacare. Indemnity Plans - these plans pay 1st dollar benefits including Dr. visits, Rx, Lab work, etc..

Obamacare or ACA plans

These plans are available to anyone under 65 regardless of medical conditions. These plans can be subsidized by the Federal Government and are typically purchased during Open Enrollment which typically is at the end of the year. But if you lose coverage you may qualify for a Special Enrollment Period.

Life, Dental, Vision and HMA's

Often when looking for health insurance it is smart to consider adding an HMA, a life plan, or maybe some dental/vision coverage. An HMA is an amazing plan which provides a Financial benefit. Click the link below to better understand HMA's.

" has been there to help me, and is so easy to work with!" - Kristen A.

Request a quote

Get Started here

Fill out the form above or click on the button below to get a personalized quote. Your information is safe, we do not sell or redistribute your information.

FAQ

How much does health insurance cost?

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

Can Alternative plans save me money?

Yes, alternative plans are typically much lower cost and can be custom designed to fit your individual or family needs.

Can't I just get a quote online?

Yes, you can shop online, but not every plan is available! Agents have access to plans you won't find there.

What is a deductible?

A deductible is the amount you pay out of pocket for covered medical services before your health insurance plan begins to cover its share of the expenses. Your deductible amount will depend on the type of plan you enroll in.

What is a health insurance premium?

A health insurance premium is the fee you must pay for your health insurance policy. Premiums are typically paid monthly, quarterly, or yearly during your period of coverage.

How do I get the best plan for me and my family?

Start with clicking on the button above, and

Anthony will reach out to you and set up a time to go over your options.

© Copyright - All Rights Reserved